How To Calculate Total Debt Servicing Ratio (TDSR)

Last Updated: Aug 18, 2022

Why Have TDSR?

A lot of measures have been taken by the Singapore government to prevent housing prices from inflating beyond control. Because of these measures, the process of procuring a house, that is suitable to the buyer’s needs, is now a daunting task. Buyers experience a lot of difficulty comprehending the term “Total Debt Servicing Ratio” and what it means for them. A rudimentary definition of TDSR identifies it as a debt service measure that tells buyers whether or not they can afford the property they wish to purchase. It tells financial lenders whether a potential buyer is already in too much debt or not.

The TDSR Framework:

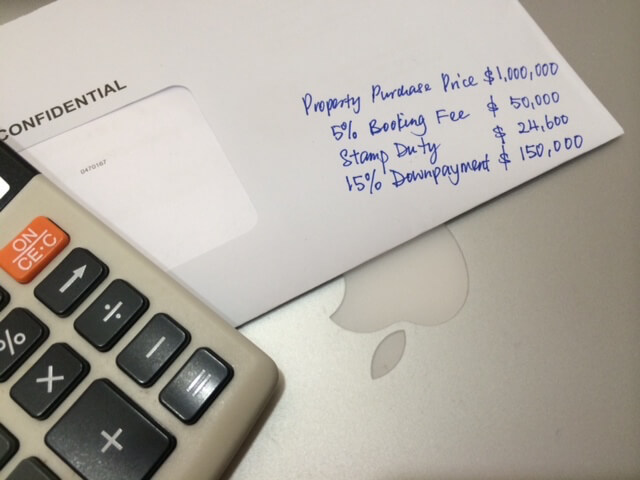

The general TDSR framework allows financial lenders to lend you 55% (note: it was previously based on 60% of gross income but wef 16 Dec 2022, TDSR has been revised to 55% of gross income) of your gross income, sans your outstanding debts and other payments. TDSR takes into account all credit card balances, car loans, student loans, personal loans, and all other loans that are applicable. Most borrowers are under the impression that the permissible limit is well-suited to their needs. However, this is rarely the case as people tend to have a plethora of obligations that affect the treatment of TDSR. TDSR is not applicable on fixed income only, but also takes into consideration a buyer whose earnings are susceptible to fluctuation. In case of a variable income earner, the buyer’s income is liable to a 30% ‘haircut’ before TDSR can be applied. The term ‘haircut’ shows the lender’s perceived risk of loss if the asset falls in value.

Another term that is worth mentioning is the ‘stress test’. The stress test is an indication of whether or not the buyer can withstand a rise in the interest rates. This measure tells the buyer if he can afford to pay larger amounts of mortgage payments.

Mortgage Servicing Ratio (MSR):

Sometimes, the buyer must also consider the MSR (Mortgage Servicing Ratio). It restricts the buyer to spend only 30% of his gross monthly income as repayments on the purchase of HDB (Housing Development Board) or EC (Executive Condominium).

Expert TDSR Advice:

Buyers can calculate the TDSR on their own, even if they do not have expert knowledge of the housing market. There are several free calculators that are available online. Even so, buyers must use this tool judiciously and must consult an authority on the subject before making a purchase.

If you are looking for a recommendation on expert TDSR advice, contact New Condo Launch | Condo Singapore

We love to help you

With so many different and exciting new condo launches in the Singapore property market, it will not be easy for you to decide which new launch condo is suitable for your purchase. Allow us to help you assess your finances, plan your priorities and determine your best options. Thereafter, we will go and view the list of developments that you have shortlisted.

Make an appointment with us today by filling in the form and we will contact you very soon.

HOTLINE: +65 6100 2500

WHATSAPP: whatsapp-NewCondoLaunchOnline